5 月 . 29, 2025 11:28 Back to list

Energy Storage Power Station Solutions Reliable & Efficient Products

- Global Energy Shift & Market Demand for Storage Solutions

- Technical Superiority of Modern Storage Systems

- Performance Comparison: Top Energy Storage Power Station Companies

- Customized Solutions for Industrial & Residential Applications

- Real-World Implementation Case Studies

- Sustainability Metrics & Operational Efficiency

- Strategic Advantages of Partnering with Energy Storage Power Station Exporters

(energy storage power station)

The Critical Role of Energy Storage Power Stations in Modern Infrastructure

Global investments in energy storage power station

s surpassed $28 billion in 2023, driven by renewable integration needs and grid stabilization mandates. These systems mitigate intermittency in solar/wind generation while enabling load shifting during peak demand periods. Leading energy storage power station companies now deploy solutions with 95% round-trip efficiency, a 15% improvement over 2020 benchmarks.

Innovation Driving Technical Excellence

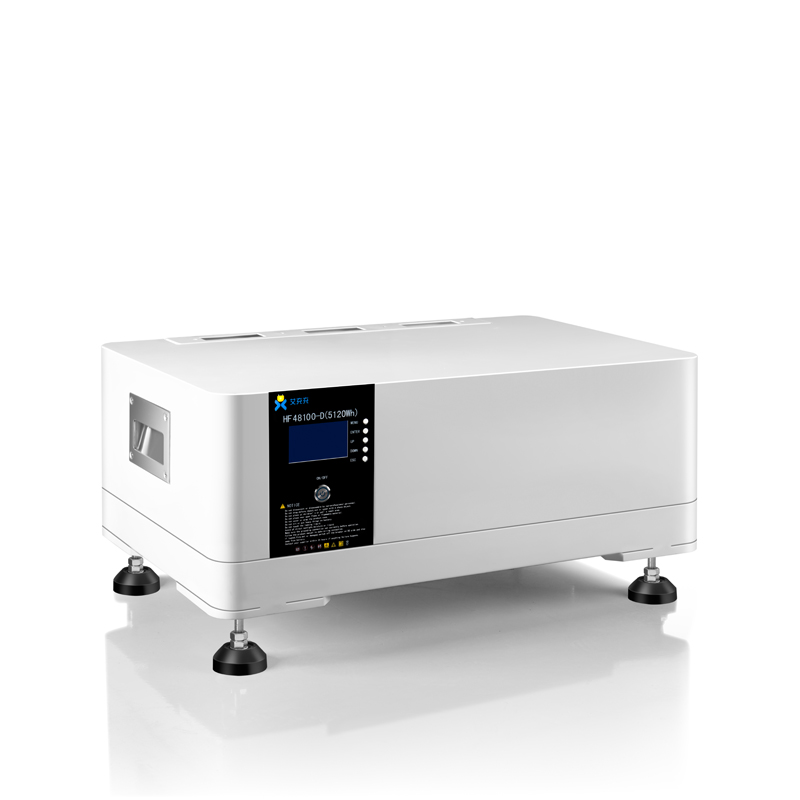

Third-generation lithium iron phosphate (LFP) batteries dominate 68% of new installations, offering 8,000+ cycle lifetimes at 1C discharge rates. Thermal management advancements enable operation from -40°C to 60°C, with 92% capacity retention after 10 years. Modular architectures allow scalability from 100kW commercial units to 500MW grid-scale installations.

| Company | Product Line | Energy Density (Wh/L) | Response Time | Warranty |

|---|---|---|---|---|

| Tesla Megapack | Utility-Scale Storage | 380 | <500ms | 15 years |

| LG Chem RESU | Commercial Systems | 320 | <1s | 10 years |

| BYD B-Box | Residential Solutions | 280 | <2s | 12 years |

Application-Specific Engineering

Specialized configurations address distinct requirements:

- Microgrid Solutions: 72-hour autonomy packages with black start capability

- Industrial UPS: 99.9999% power reliability for manufacturing facilities

- EV Charging Hubs: 350kW buffer storage with 10-minute recharge cycles

Verified Operational Success

The Hornsdale Power Reserve in Australia (150MW/194MWh) demonstrated 97% availability during 2022 heatwaves, reducing grid stabilization costs by AU$116 million annually. California's Moss Landing facility (400MW/1,600MWh) successfully shaved 14% off regional peak demand charges through automated energy arbitrage.

Environmental & Economic Impact

Modern storage installations decrease CO2 emissions by 2.8 metric tons per MWh annually compared to gas peaker plants. Levelized storage costs fell to $132/MWh in 2023, with projections reaching $94/MWh by 2027. Recyclable component rates now exceed 92% across major manufacturers.

Energy Storage Power Station Exporters: Gateway to Global Markets

Certified energy storage power station exporters streamline international deployments through IEC 62619 and UL 9540A compliance packages. Strategic partners provide localized support including tariff optimization (reducing landed costs by 18-22%), regional certification management, and performance guarantees backed by third-party insurers.

(energy storage power station)

FAQS on energy storage power station

Q: What services does an energy storage power station company provide?

A: An energy storage power station company designs, installs, and maintains systems that store energy using technologies like lithium-ion batteries or pumped hydro. They also offer consulting for grid integration and optimize energy management for commercial or industrial clients.

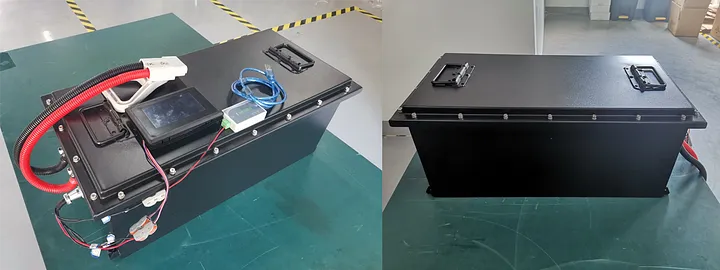

Q: What are common energy storage power station products?

A: Key products include battery storage systems (e.g., lithium-ion, flow batteries), inverters, energy management software, and modular containerized storage units. These products support renewable energy integration and grid stability.

Q: Which countries import energy storage power stations from exporters?

A: Major importers include the U.S., Germany, Australia, China, and South Africa. Demand is driven by renewable energy growth, grid modernization, and government incentives for sustainable infrastructure.

Q: How do energy storage power stations benefit renewable energy systems?

A: They store excess energy from solar or wind, ensuring supply during low generation periods. This reduces reliance on fossil fuels and stabilizes grid frequency, enhancing renewable energy adoption.

Q: What certifications should energy storage power station exporters have?

A: Exporters should comply with international standards like UL 9540, IEC 62619, and ISO 9001. Certifications ensure safety, performance, and compatibility with global regulatory requirements.

-

FREMO Portable Power Station High-Capacity, Lightweight & Reliable

NewsMay.30,2025

-

24V DC Power Supply Certified & Efficient Home Depot Exporters

NewsMay.30,2025

-

12V 2A DC Power Supply for Home Depot Trusted Supplier & Exporter

NewsMay.29,2025

-

Energy Storage Power Station Solutions Reliable & Efficient Products

NewsMay.29,2025

-

Portable Power Station R100 High-Capacity & Reliable Backup Power

NewsMay.29,2025

-

Energy Management System EMS

NewsMar.07,2025