2 月 . 01, 2025 05:43 Back to list

Energy Management System EMS

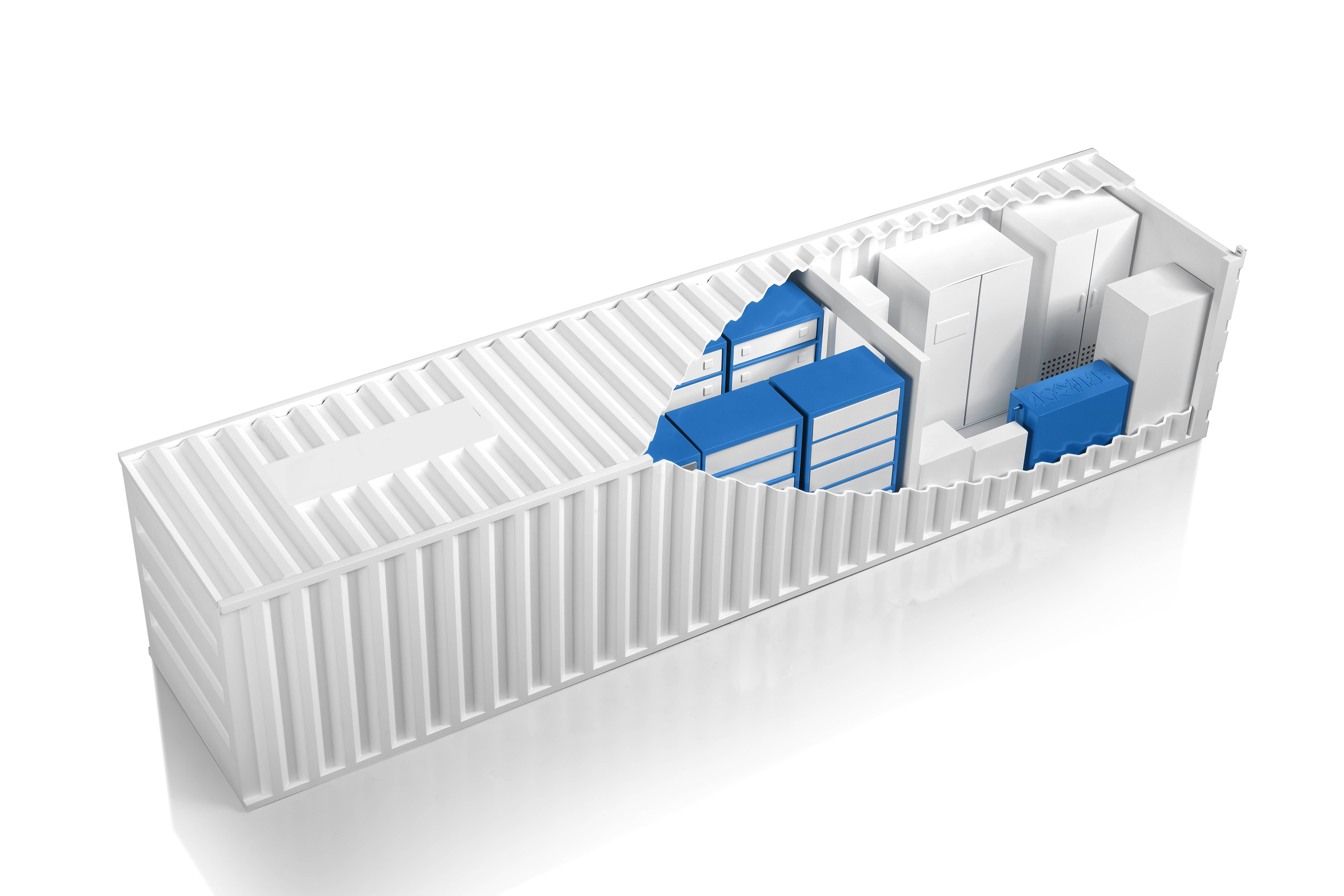

Energy storage financing stands as a crucial pillar in the transition towards sustainable energy solutions. With the global move towards renewable energy, the demand for effective energy storage solutions is paramount, requiring substantial financial investment and innovative funding approaches. Here we delve into the comprehensive aspects of energy storage financing, focusing on product-level experience, expertise, authoritativeness, and trustworthiness.

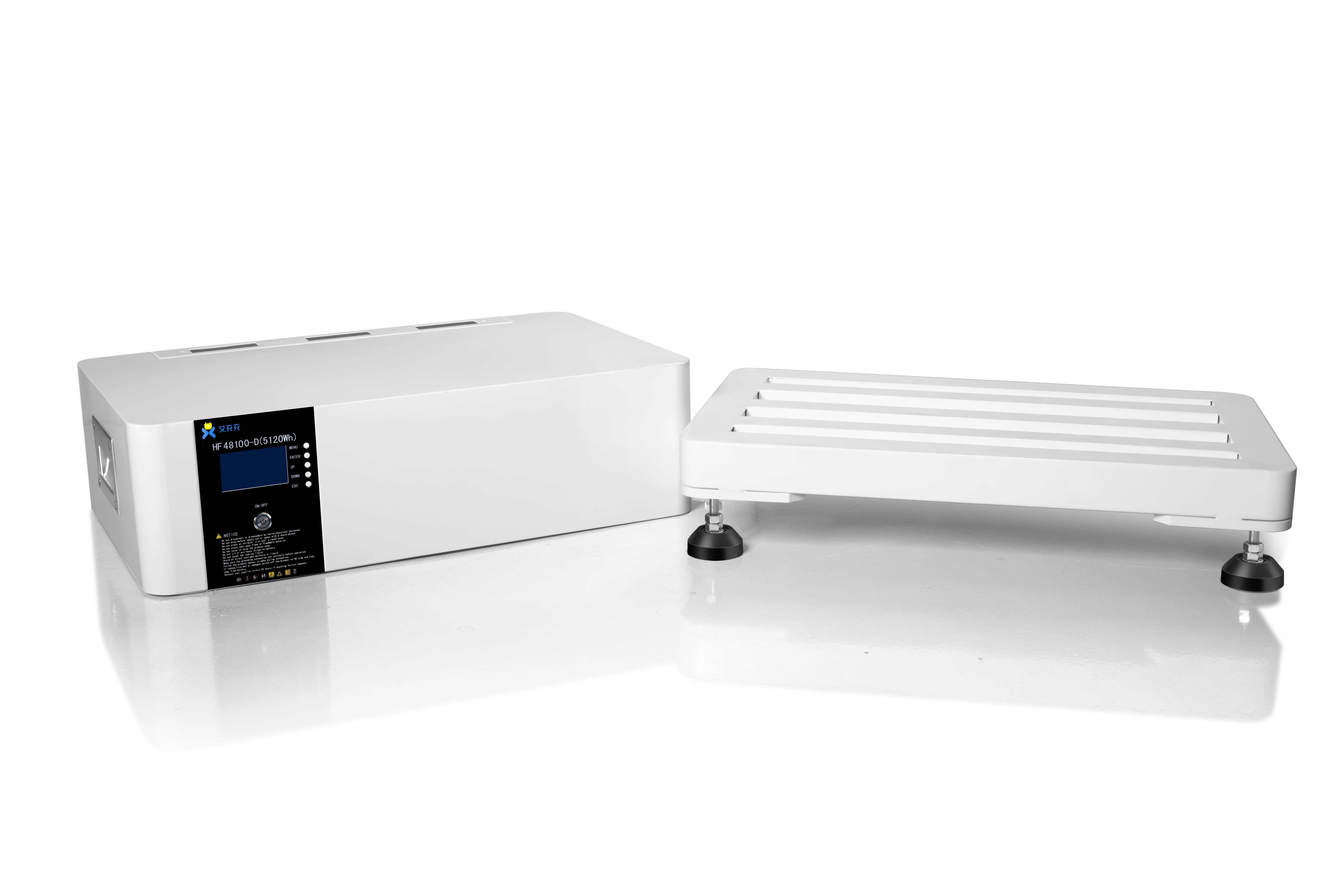

Moreover, the burgeoning market of residential energy storage products, such as home batteries, points towards a democratization of energy storage financing. These products, supported by consumer financing options and subsidies, illustrate how financing is not limited to large-scale industrial applications but extends to empowering individual consumers. This dispersed adoption model underlines the need for flexible financing plans tailored to varied demographic and geographic segments, accommodating economic and regulatory disparities across regions. Successfully financing energy storage projects necessitates collaboration between multiple stakeholders, including private enterprises, government bodies, and financial institutions. This collaboration facilitates the pooling of resources and sharing of risks, crucial in an industry characterized by rapid technological evolution and a high degree of uncertainty. Finally, the path to successful energy storage financing is punctuated by continuous innovation. The rise of blockchain technology and AI-driven predictive analytics is opening new avenues for transactions and efficiency improvements in energy storage financing. Smart contracts, driven by blockchain, can streamline and secure transactions, while data analytics offers insights into optimizing storage utilization, thereby refining financial models. In essence, energy storage financing is a dynamic field demanding expertise, integrity, and innovative foresight. The synergy between financial strategies and technological advancements continues to redefine the viability and scalability of energy storage solutions, playing an indispensable role in achieving a sustainable energy future. As the market evolves, the ability to forecast trends, anticipate ROI, and innovate within regulatory frameworks remains paramount for stakeholders invested in energy storage financing.

Moreover, the burgeoning market of residential energy storage products, such as home batteries, points towards a democratization of energy storage financing. These products, supported by consumer financing options and subsidies, illustrate how financing is not limited to large-scale industrial applications but extends to empowering individual consumers. This dispersed adoption model underlines the need for flexible financing plans tailored to varied demographic and geographic segments, accommodating economic and regulatory disparities across regions. Successfully financing energy storage projects necessitates collaboration between multiple stakeholders, including private enterprises, government bodies, and financial institutions. This collaboration facilitates the pooling of resources and sharing of risks, crucial in an industry characterized by rapid technological evolution and a high degree of uncertainty. Finally, the path to successful energy storage financing is punctuated by continuous innovation. The rise of blockchain technology and AI-driven predictive analytics is opening new avenues for transactions and efficiency improvements in energy storage financing. Smart contracts, driven by blockchain, can streamline and secure transactions, while data analytics offers insights into optimizing storage utilization, thereby refining financial models. In essence, energy storage financing is a dynamic field demanding expertise, integrity, and innovative foresight. The synergy between financial strategies and technological advancements continues to redefine the viability and scalability of energy storage solutions, playing an indispensable role in achieving a sustainable energy future. As the market evolves, the ability to forecast trends, anticipate ROI, and innovate within regulatory frameworks remains paramount for stakeholders invested in energy storage financing.

Latest news

-

FREMO Portable Power Station High-Capacity, Lightweight & Reliable

NewsMay.30,2025

-

24V DC Power Supply Certified & Efficient Home Depot Exporters

NewsMay.30,2025

-

12V 2A DC Power Supply for Home Depot Trusted Supplier & Exporter

NewsMay.29,2025

-

Energy Storage Power Station Solutions Reliable & Efficient Products

NewsMay.29,2025

-

Portable Power Station R100 High-Capacity & Reliable Backup Power

NewsMay.29,2025

-

Energy Management System EMS

NewsMar.07,2025